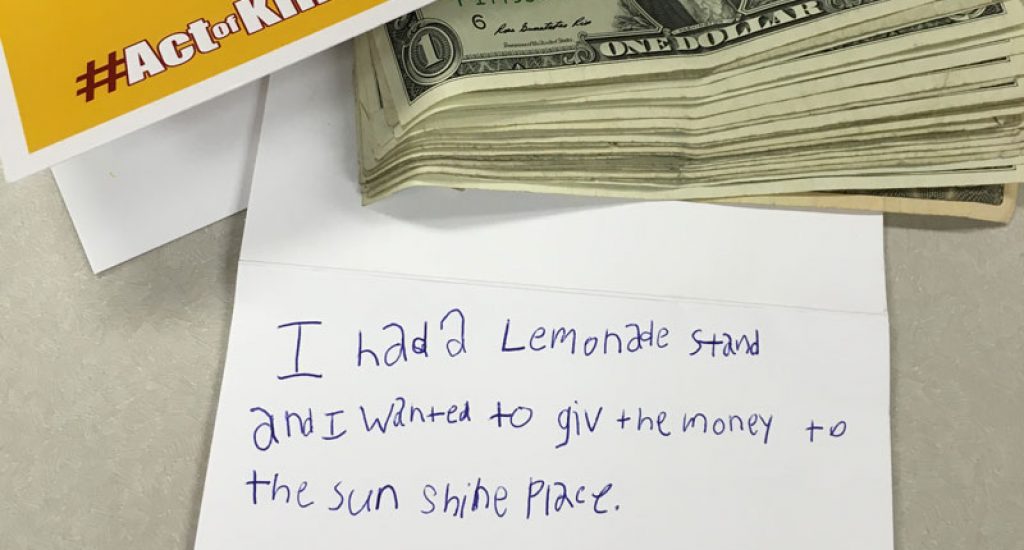

Monetary Donations

A one-time or recurring gift to Sunshine Place allows us to continue important community programs that our neighbors depend on. Making a gift by cash, check, (preferred to avoid credit card processing fees), or credit card is always an option. We can accommodate automatic withdrawals from a bank account or recurring charges on a credit card at intervals you select. Cash gifts may also have tax advantages depending on your income and the amount of your deductions when compared to the standard deduction amount. Click below to donate now or mail checks to:

Sunshine Place

18 Rickel Road

PO Box 307

Sun Prairie, WI 53590

Additional Charitable Giving Opportunities

Sunshine Place’s service model aims to increase equity by providing one-stop access to essential needs and support for community members in crisis or with limited means. Our programs provided over 130,000 touchpoints of service in 2024 – more than double just two years ago. As a nearly 100% community supported organization, we rely on donations and grants to sustain vital programs that help those facing food insecurity, housing insecurity, and other barriers to family and household stability. The need is greater than ever, and your support will help ensure that we can continue to care for our neighbors in the face of record need. With this in mind, we are working towards a long-term vision that allows us to continue to expand and refine our current resources so that every person who accesses our services can thrive. We can’t achieve this without you!

Explore the options below for a variety of ways you can support Sunshine Place efforts. Visit our in-kind donation page for information on donating food or items.

This webpage provides a summary of common charitable gift options but is not intended as legal, tax or accounting advice and it may not be relied on for such advice. Please speak with your professional advisor with any questions regarding charitable gifts.

There may be significant tax advantages to you when you donate appreciated stocks or mutual fund shares that you’ve held for more than one year.

- You may reduce your income tax if you have sufficient deductions (including the gift) to itemize your deductions. Your gift equals the full appreciated value of the security. For example, if you bought the stock for $5,000, and it’s now worth $15,000, your charitable gift is $15,000.

- You will not recognize the capital gains on the appreciated security assuming your gift is in the form of the security. Thus, you save capital gains taxes on the $10,000 of gain you would have recognized if you sold the securities outright and then gifted the cash.

- To take advantage of these tax benefits the security must be directly transferred from your broker to Sunshine Place.

Note: Stocks can be considered appreciated securities if their market value has increased since they were acquired. It is a simple process to transfer appreciated securities, and we can provide transferring instructions to your broker at your request.

Donor-advised funds (DAF) are the fastest-growing charitable giving vehicle in the U.S. because they are one of the most straightforward and tax-advantageous ways to give.

When you contribute cash, securities, or other assets to a donor-advised fund, you are generally eligible to take an immediate tax deduction. These funds can then be invested to achieve tax-free growth and used to support charities like Sunshine Place at a pace that is comfortable for you.

Making a gift to Sunshine Place through your donor-advised fund (DAF) is easy. For the convenience of our friends who have donor-advised funds, please be sure to share our legal name, address, and federal tax ID number with your DAF administrator.

A QCD is a direct transfer of funds, up to a total of $108,000 per year, from your IRA custodian, after you reach age 70.5, to qualified charitable organizations like Sunshine Place. A QCD will be counted as part of your Required Minimum Distribution (RMD) if it is made after you reach age 72; prior to that time, there is no RMD. Making a QCD from your IRA can have tax advantages if you are at least 70.5 years of age.

When you reach age 72, you’re required to withdraw a certain amount of money from your certain retirement accounts each year. Giving your RMD directly to a nonprofit organization provides tax advantages (see QCD above for more information).

Choose to leave a designated monetary amount or a percentage of your estate to Sunshine Place in your official will.

When you name Sunshine Place as your life insurance beneficiary, we receive the benefit proceeds from that policy when you pass away, ensuring that your impact endures.

Naming a charity like Sunshine Place as your beneficiary for IRA or retirement allows you to support an organization you care about, with potentially significant income tax and estate planning benefits for you.

For additional forms of charitable gifts that offer other advantages, please contact your attorney or financial advisor. Lastly, please contact your professional advisor with any questions about the tax impact of charitable gifts customized to your unique circumstances.

Supporters like you are one of our most valuable assets. Thank you for helping to support essential programs in your community that your neighbors rely on. We could not do this work without you.

Click here to print or save a document listing the above giving options for future reference. For more information about implementing one of the above gift options:

Ann Maastricht

Sunshine Place, Executive Director

Email: ann@sunshineplace.org

*Please note, this is a summary of common charitable gift options but is not intended as legal, tax or accounting advice and it may not be relied on for such advice. Speak with your professional advisor about any questions regarding charitable gifts. Sunshine Place is a 501(c)(3) non-profit org., EIN: 20-5398498. Gifts are tax deductible as allowed by law.